The World has changed in the past years but has Mexico? Yes it has!

Let’s discuss exactly what you need to share with your clients before their trips

Written By: Tom and Joanie Ogg, CTC, MCC, Co-Founders and Co-Owners – HomeBasedTravelAgent.com

We have had a decades long relationship with Mexico and know it quite well. We have owned condos in Punta Mita for over 25 years, including a condo rental business. However, our lives have changed dramatically as for medical reasons, Tom had to stop surfing about three years ago. Since he started surfing in 1958 and never stopped, this has been a major life event for us.

When Tom stopped, we decided to simply keep our home in Punta Mita and spend time there when it made sense. However, in late 2021 and 2022 the real estate market seemed to explode in Mexico, so we decided that we would cash in on the overwhelming demand and sell of condo.

We closed on our condo in June of 2022 and did quite well on it. We were glad that we had made the decision to sell, as we wanted to start traveling again and having a second home kind of stands in the way of that. As it turns out, we are ecstatic that we sold with the economic events that have taken place since.

Mexico’s Peso Becomes King

While at the time we sold, no one saw what was happening to the dollar to peso conversion ratio which was occurring. I well remember the exchange rate back in the 1980s when the peso went from 23 to 1 in 1980 to 1993 when the peso exceeded 3,000 to 1 before the Mexican government simply eliminated 3-figures from the peso. Wild fluctuations have occurred over the years, but the dollar was always the beneficiary. Here is what’s happening currently.

On July 20th, 2020 one U.S. dollar was worth $20.56 pesos. Exactly one year later on July 20th, 2023 one U.S. dollar was worth $16.71 pesos. This is a loss of value for the U.S. dollar of 19%. Worse, on April 25th, 2020 one U.S. dollar was worth $24.98 pesos. From the start of the COVID pandemic until today the dollar has lost 33% of its value against the peso.

There are several things that have contributed to the loss of value and while no one is certain of what has happened, here are some more obvious things to consider. These are important to explore, as the future of the dollar in relationship with the peso will hinge on these issues.

Inflation

It is no secret that the U.S. has been battling high inflation numbers. since 2020. When the U.S. inflation rate exceeds the inflation rate in Mexico, the currency will lose value against Mexico’s peso.

Interest Rates

Mexico’s Central Bank has just raised their prime rate to 11.25% which bolsters support for the peso and will have a dramatic effect in lowering Mexico’s inflation rate. The U.S. Central Bank Prime rate is 5.25% which is having an effect on inflation, but certainly not as dramatic as Mexicos.

Capital Investment

Both the United States and China are investing heavily in the Mexican economy by building manufacturing plants, infrastructure and other capital intensive investments.This has created a burgeoning economy for Mexico’s middle class and elevated incomes and lifestyles.

There are many other factors that go into the value of a nation’s currency such as geopolitical impact, the trade balance and overall economic performance. No one knows if the slide of the dollar will continue, but there are issues that you should explain to your clients.

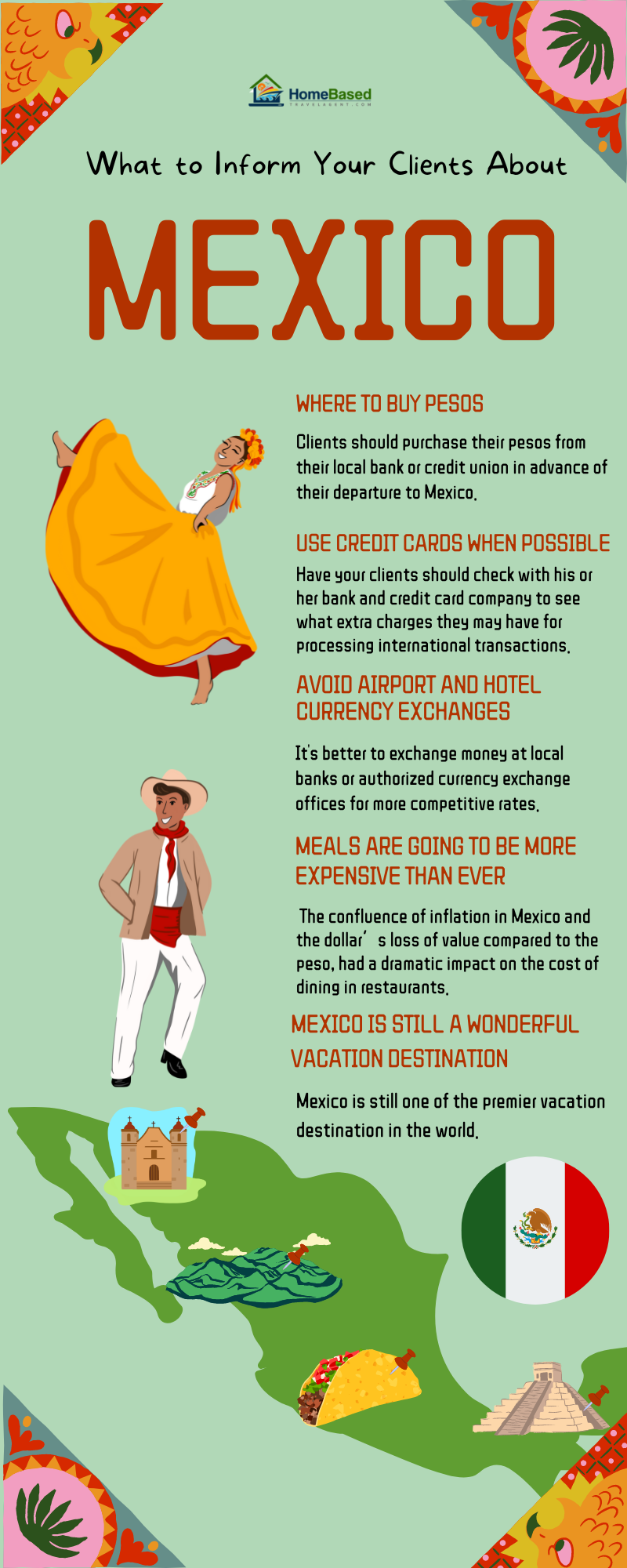

What to Inform Your Clients About Mexico

Right from the moment you start discussing Mexico as an option for your client’s vacation, you should explain that the currency exchange fluctuation is something that they should be aware of. Here are topics you should discuss with your client.

Where to Buy Pesos

Clients should purchase their pesos from their local bank or credit union in advance of their departure to Mexico. This is where they will get the best exchange rate. The ATMs in Mexico offered competitive rates at one time, but now offer rates on par with the currency exchange businesses. Often the “street value” of a dollar is 10 to 20% lower than the actual exchange rate making the dollar worth that much less. Clients should never use U.S. currency to pay for meals or services as the provider will certainly not give a fair exchange rate. Many times, they will exchange the dollar on a 10 to 1 basis making the meal or service very expensive.

Use Credit Cards When Possible

Have your clients should check with his or her bank and credit card company to see what extra charges they may have for processing international transactions. Also have them suggest the best ways to obtain pesos while out of the country. Many of the tourist oriented restaurants and attraction will take credit cards.

Avoid Airport and Hotel Currency Exchanges

Airport and hotel currency exchange services often charge high fees and offer less favorable rates. It’s better to exchange money at local banks or authorized currency exchange offices for more competitive rates.

Meals are Going to be More Expensive Than Ever

On my last trip to Mexico (June 2023) I was shocked at how much prices in restaurants had gone up. The confluence of inflation in Mexico and the dollar’s loss of value compared to the peso, had a dramatic impact on the cost of dining in restaurants. I would estimate that it was 40 to 60% more expensive dining in restaurants that I had dined at in 2022.

Mexico is Still a Wonderful Vacation Destination

While the exchange rate is not what it was, Mexico is still one of the premier vacation destination in the world. Mexico’s culture, history, culinary delights and fabulous beaches are still as they were, undeniably spectacular.