Choose Your Travel Business Structure

Since everyone’s financial situation is different, there is no one correct answer for everyone regarding the best business entity for travel businesses. The best and only person to advise you as to the right business entity for your travel business is an attorney and / or an accountant competent in such matters. Before you start your travel business you should visit with both an accountant and an attorney. Decisions that you make when starting can affect you from a tax and a liability perspective and need to be dealt with properly. While it will cost you some money to seek this advice, it is money well spent.

Key Issues to Discuss with Your Legal and Tax Professional

Control: If you are a one-man or one-woman business, what happens to your ability to control the business under the various business entities? There are many decisions that you will need to consider, as each business entity has its positives and negatives.

Liability: How exposed is the business entity you decide to use to lawsuits and how might it affect your personal assets? How does it affect your business assets? Given your specific financial position, what protection would your legal, or tax professional suggest you take to protect yourself from loss based on litigation?

Taxation: Each business entity is taxed differently. What is the impact of the entity you choose going to have on your taxes? What is the cost of complying with accounting standards imposed by the entity going to be? What is the additional cost of filing tax returns going to be? Many professionals like the use of Subchapter (S) Corporations, but be sure you completely understand what the true costs of operating one are.

Survivability: What happens to the business when you pass away? What are the issues of providing for the business distribution in you will or trust? Survivability of the business is critical if you intend to leave to someone in your family, or want it sold.

The Various Types of Business Entities to Consider

This article is only to introduce you to the various types of ownership options that you can discuss with your financial advisor and/or attorney. Each form of ownership has benefits and drawbacks and also, may have unintended consequences. So let’s take a brief look at your options.

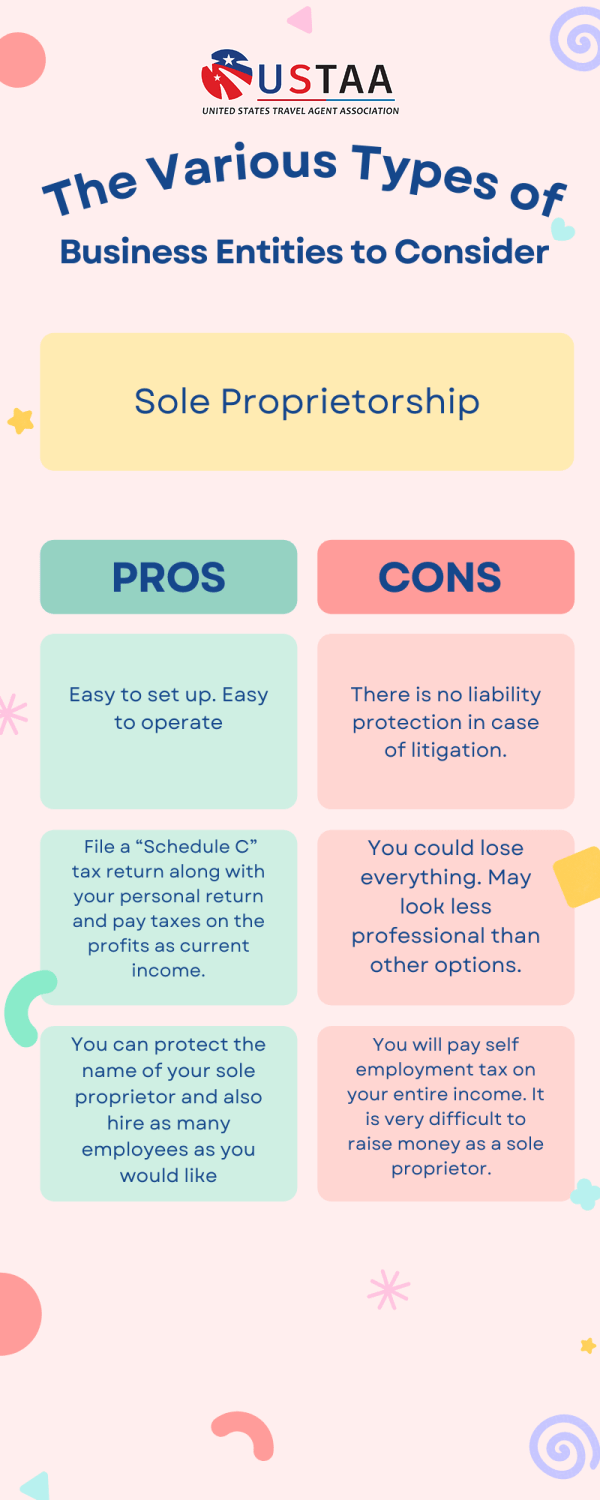

Sole Proprietorship

This is by far the easiest entity to engage. All you have to do is declare your business and operate it as such. Each State may have different requirements for establishing a sole proprietorship so it is important to have your attorney or accountant advise you on the requirements.

Positives: Easy to set up. Easy to operate. File a “Schedule C” tax return along with your personal return and pay taxes on the profits as current income. You can protect the name of your sole proprietor and also hire as many employees as you would like

Negatives: There is no liability protection in case of litigation. You could lose everything. May look less professional than other options. You will pay self employment tax on your entire income. It is very difficult to raise money as a sole proprietor.

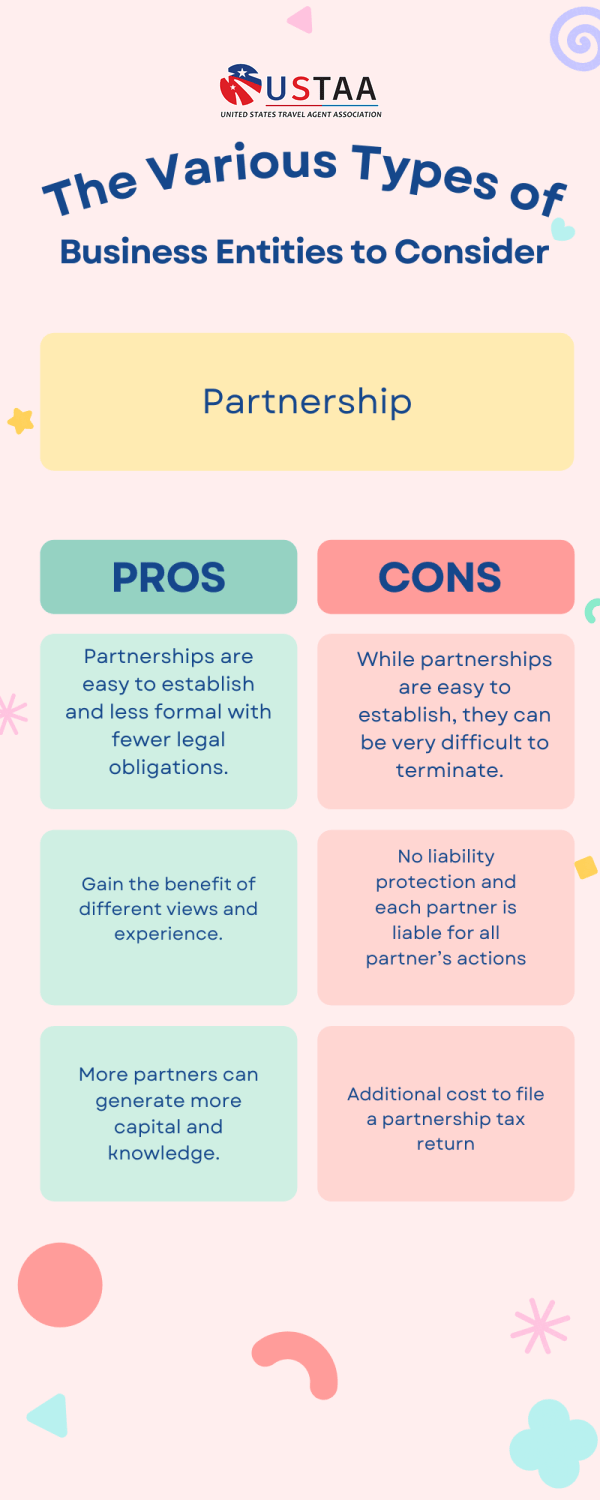

Partnership

Partnerships are easy to establish, but many times much more difficult to dissolve. Again, each state may have partnership laws unique to that state. Be sure to have your attorney involved.

Positives: Gain the benefit of different views and experience. File partnership tax return and distribution of profits to partners is taxed as current income. Easy to get started and less formal with fewer legal obligations. More partners can generate more capital and knowledge.

Negatives: Partner disputes can cause the partnership to dissolve. Additional cost to file a partnership tax return. No liability protection and each partner is liable for all partner’s actions. While partnerships are easy to establish, they can be very difficult to terminate.

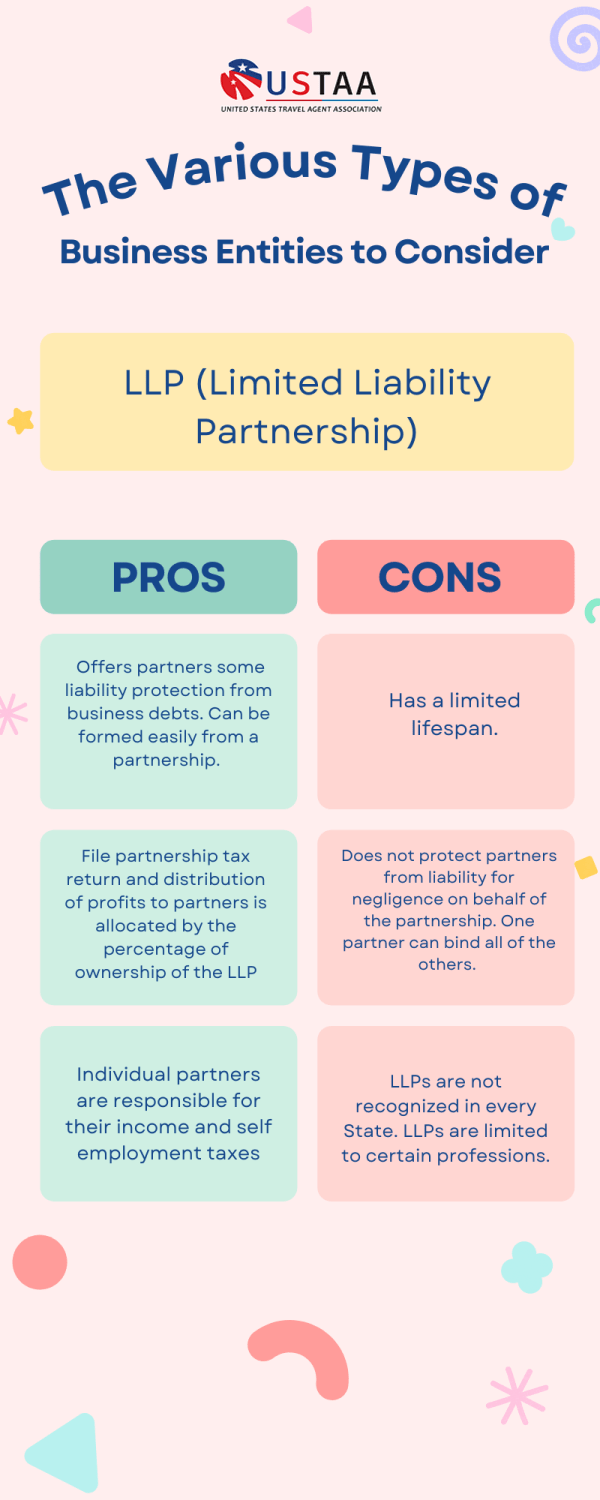

LLP (Limited Liability Partnership)

LLPs are usually used by professionals to limit the individual partner’s liability for business debts.

Positives: Offers partners some liability protection from business debts. Can be formed easily from a partnership. File partnership tax return and distribution of profits to partners is allocated by the percentage of ownership of the LLP. Individual partners are responsible for their income and self employment taxes.

Negatives: Has a limited lifespan. Offers partners limited liability in most cases. Does not protect partners from liability for negligence on behalf of the partnership. One partner can bind all of the others. LLPs are not recognized in every State. LLPs are limited to certain professions.

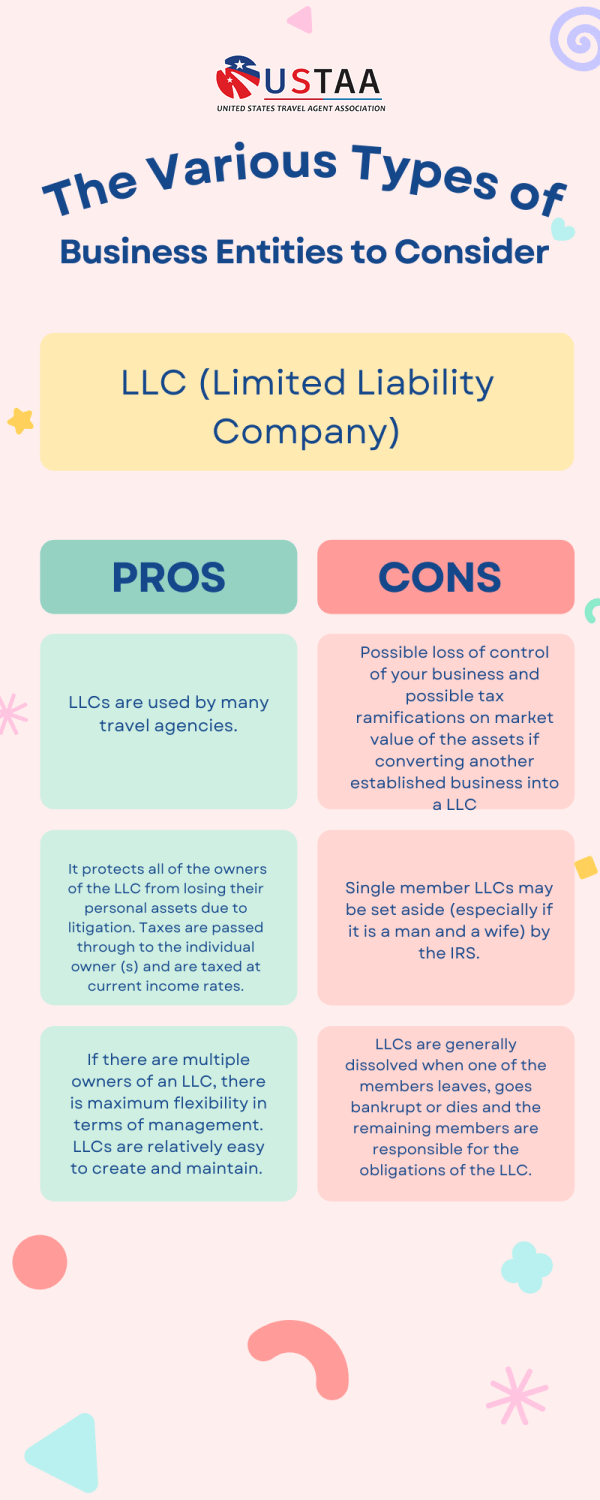

LLC (Limited Liability Company:

LLCs differ from LLPs in that they act more like a corporation than a partnership. LLCs are used by many travel agencies.

Positives: Liability is the main reason to use a LLC. It protects all of the owners of the LLC from losing their personal assets due to litigation. Again, taxes are passed through to the individual owner (s) and are taxed at current income rates. If there are multiple owners of an LLC, there is maximum flexibility in terms of management. LLCs are relatively easy to create and maintain.

Negatives: Possible loss of control of your business and possible tax ramifications on market value of the assets if converting another established business into a LLC. Single member LLCs may be set aside (especially if it is a man and a wife) by the IRS. LLCs are generally dissolved when one of the members leaves, goes bankrupt or dies and the remaining members are responsible for the obligations of the LLC.

Sub-Chapter S Corporation:

A sub-chapter S corporation has all of the benefits of a corporation in terms of liability and perpetual existence. They also offer interesting tax opportunities as you can put yourself on a salary and then take out the additional profits as a distribution not subject to payroll taxes. This is one of the main reasons to go with a S Corp. This is a great choice if your agency is doing quite well.

Positives: it is not taxed at the corporate rate and profit pass through to the owners and are taxed at their personal tax rate. Once a year tax filing (not 4 times a year as in a corporation) You enjoy limited liability S-Corps are recognized in all 50-states and courts uphold the promise of no liability. S-Corps survive the owner’s death. S-Corps are perfect for successful travel businesses.

Negatives: Cost of creating and maintaining a Sub-Chapter S Corporation. There may also be closer scrutiny by the IRS than with a LLC. You definitely should consult with your tax professional before starting a S-Corp as there are several considerations that may impact estate planning, appreciating assets and other tax and legal elements. Also, each State has different requirements and fees. California, as an example has a franchise tax fee of $800 and a corporate California source income tax rate of 1.5%.

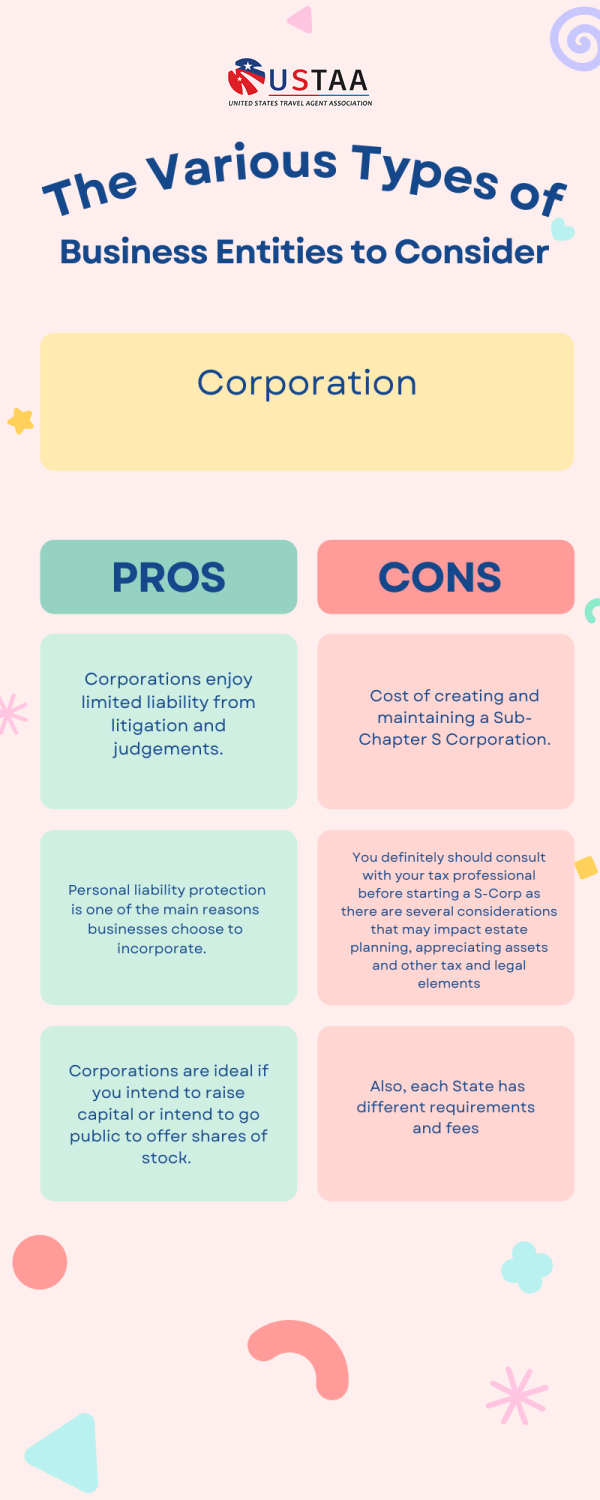

Corporation

Corporations are used by many to limit liability and insure survivability upon death.

Positives: Corporations enjoy limited liability from litigation and judgements. Personal liability protection is one of the main reasons businesses choose to incorporate.Corporations have an excellent perpetual existence and transfer of ownership is easy to accomplish. They may also have some tax benefits for non-distributed profits. Corporations are ideal if you intend to raise capital or intend to go public to offer shares of stock.

Negatives: Corporation profits are taxed twice, once at the corporate tax rate and then when the profits are distributed to owners and employees, at their personal tax rate. Corporations are much more regulated than other forms of ownership. Since corporations must use the accrual method of accounting by law, the cost of keeping records is considerably higher than other forms of ownership. Corporations also have rigid formalities, protocols and regulations that must be adhered to which drives the cost of operation a corporation up making corporations the most expensive form of business entity. Once again, California has a franchise tax fee of $800 and a State of California income tax rate of 8.84%. This on top of California’s personal income tax rate of 12.3% make operating a C Corp in California punitive

As you can easily see, there is a substantial amount to consider when choosing your business entity for your travel agency. Be sure to seek the expert advice of an attorney and/or accountant before making your decision. Don’t think that you cannot change your business structure as you grow, as you most certainly can. A natural progression might be that you start as a sole proprietorship and when the business starts performing nicely you might change it to a LLC. Then, once the business is doing really well, change to a Subchapter S Corporation.