Think About Your Insurance

As travel professionals, we are all familiar with the need for Errors and Omissions Insurance and General Liability Insurance. Do we need any other insurance coverage when we operate our travel business? This question comes up frequently at seminars and in the Travel Forums. I must say that I have never been big on insurance personally speaking. When I was young of course, I thought I did not need health insurance, then as I got older and wiser and realized I had simply been lucky not to have had to call on it for help.

We know we must have car insurance. We must have homeowners insurance. Some people have dental and or eye insurance. Many people feel strongly that life insurance is a must. Our dog recently had to have some surgery and I certainly wished I had opted for pet insurance when she was younger. I think the bill for the procedure was well over $2,000. After researching on the Internet and consulting with some other agents and our insurance agent, I have some facts and insight to share with you.

Insurance is rather dry subject matter at best, however bear with me and we will try to have some fun with it! Let’s consider what scenarios and perhaps what types of insurance might be needed to protect you and your home based travel business.

I remember a few years ago, a friend of ours who is an agent working from her home in Oregon was the victim of a terrible home fire that burned her home and all in it to the ground. Nothing was salvageable and beyond the sadness and shock of it all, there was her travel agency to consider. The computers and of course all records were destroyed in the fire and she had clients trips booked and in the works. Could we remember all the details if this happened to us? I know I could not and the thought of even trying to recreate my home office is mind-boggling. That’s why the least expensive insurance that you can invest in is cloud back up for your business computer.

Do any of you have clients who come into your home to discuss their trips and plan their travels? How about a neighbor who drops by to have coffee and ultimately ends up buying a cruise that day? Are they your client or a friend and what difference would it make if he or she tripped on your oriental rug and were seriously hurt? Could they sue you for the medical fees? We all know the answer is probably yes and how would you protect yourself and your business financially? What if you were robbed while out delivering documents to a client? Are you adequately insured so that you can replace those stolen articles? If we begin to let our minds wander in this direction, it can get downright scary to think about what could happen.

In starting or operating a business there is a term used call “risk management”. This can refer to a planned approach by the business owner to do what they can to avoid loss of assets, lawsuits, or losses of earning potential.

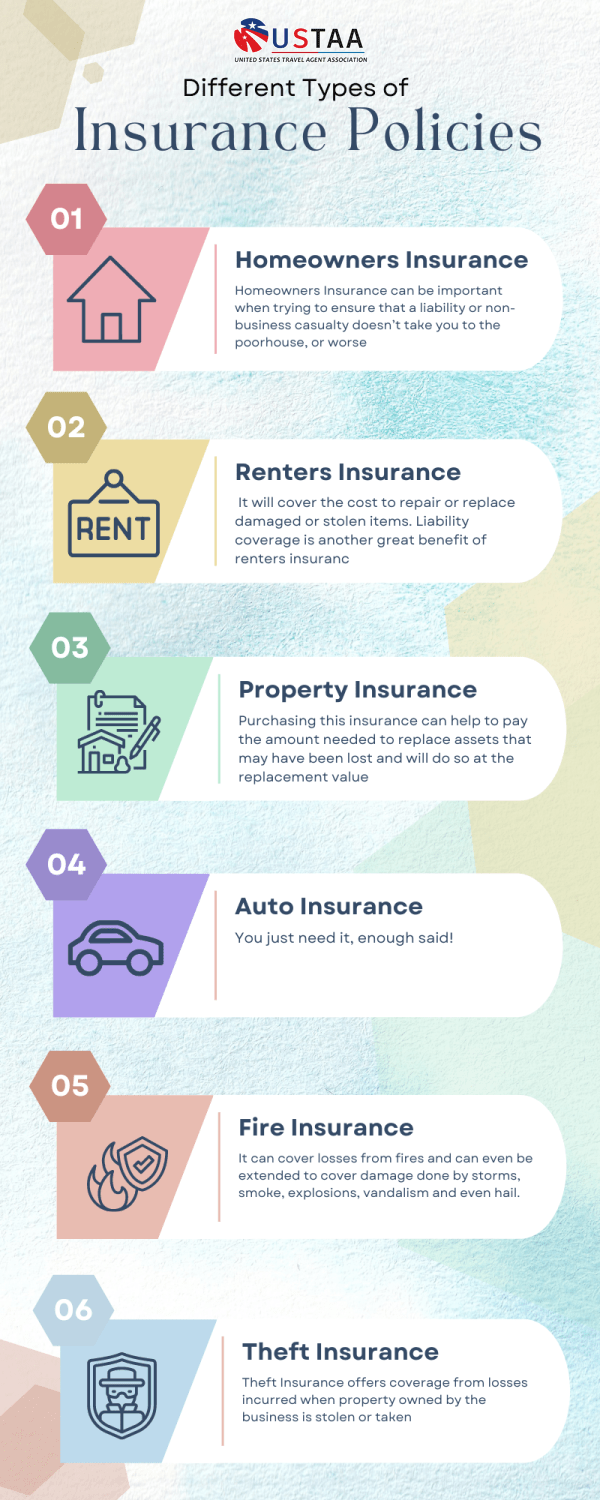

There are a number of different types of insurance policies available depending on your business needs. Following are some that might target a home based travel agency. There are probably more, as in my quest of information, I realized you can get insured for just about anything if you are willing to pay a premium. Take a look at these and just make sure you have considered whether or not you might need this to protect your growing travel agency.

Different Types of Insurance Policies

Homeowners Insurance

Homeowners Insurance can be important when trying to ensure that a liability or non-business casualty doesn’t take you to the poorhouse, or worse. Most of you who own a home probably have this already, but be sure you speak to your insurance representative to advise them you are running a business from home. There may be specific additions to the policy that you need. This type of insurance commonly covers items like: damage to a home and your personal properties that may be caused by lightning, wind, severe storms and / or fire. It can cover medical payments for occupants if injuries are incurred as a result of the above events. You can also get a rider that can cover loss or theft of your personal property, such as office equipment like computers, notebooks, smart phones, fax machines, printers, scanners, digital cameras, etc.

Renters Insurance

Renters Insurance is an option if you do not own your residence. Specifically, renters insurance covers your personal property such as clothing, computers and other business equipment. It will cover the cost to repair or replace damaged or stolen items. Liability coverage is another great benefit of renters insurance. If you get displaced for any reason, renters insurance will also cover any additional costs of living that may occur.

Property Insurance

Property Insurance can protect the business against loss of assets. Purchasing this insurance can help to pay the amount needed to replace assets that may have been lost and will do so at the replacement value. This may seem more important for a business with tangible products one can touch. Since travel sales are more of a service sale, property insurance may not make sense. Your call though, check out the options.

Auto Insurance

You just need it, enough said!

Fire Insurance

Fire Insurance can really be important and some folks cannot get this coverage depending on whether they are in an area prone to fires, or not. It can cover losses from fires and can even be extended to cover damage done by storms, smoke, explosions, vandalism and even hail.

Theft Insurance

Theft Insurance offers coverage from losses incurred when property owned by the business is stolen or taken. If you employ people for your home based business this can provide protection from employee activities, such as destruction of property, theft, dishonesty, credit card transactions and deposits, forgery, and even computer crime such as “electronic funds transfer” and other types of computer and electronic crimes. It might also protect businesses from liability or loss due to computer and even non-computer related theft and fraud. Hopefully this is not going to be something you need but now you know about it.

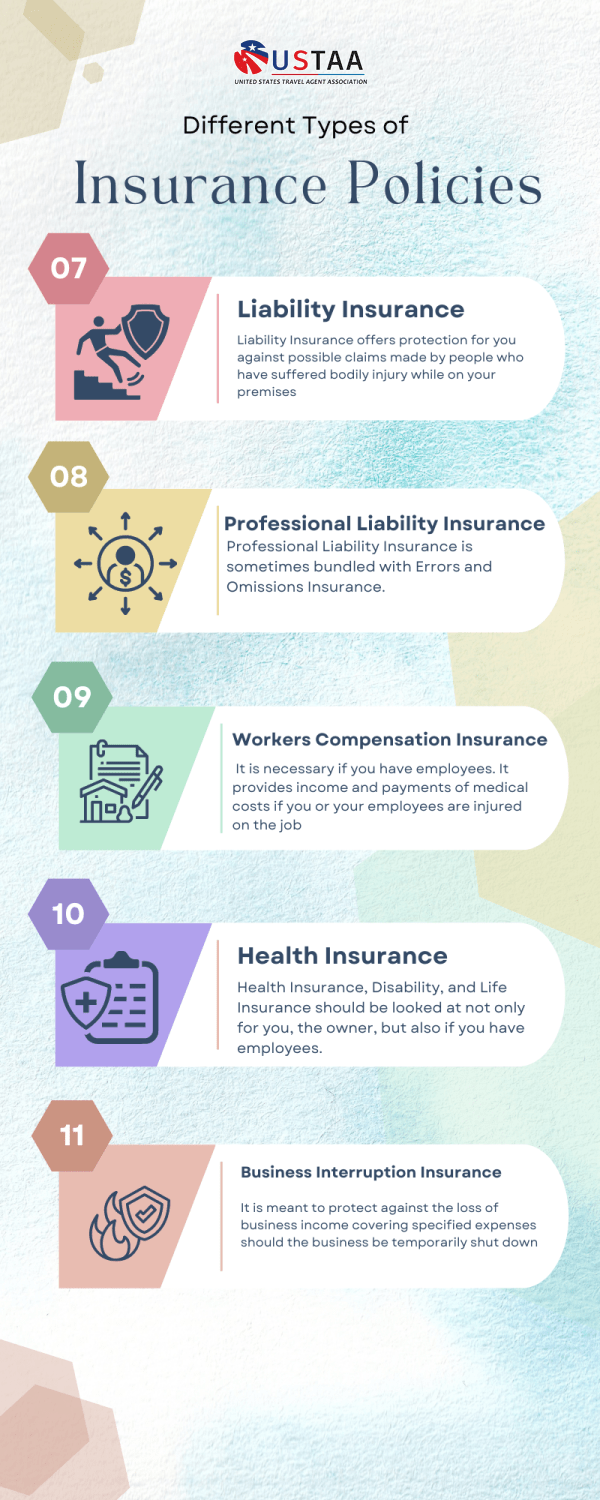

Liability Insurance

Liability Insurance offers protection for you against possible claims made by people who have suffered bodily injury while on your premises. An example might be a UPS man who slips on your doorstep that was a bit wet while they’re on business delivering a package to your business. Scary stuff isn’t it?

Professional Liability Insurance

Professional Liability Insurance is sometimes bundled with Errors and Omissions Insurance. It really is absolutely necessary to protect you and your business. If you are a travel counselor you likely give advice on places to go, companies to travel with and on, etc. What if something goes wrong on the trip? Examples may be the hotel claims they never received the deposit and the client must find another place to stay therefore blaming you and asking for reimbursement of all kinds of expenses, perhaps not limited to the hotel stay but including meals, etc. Another example that we see often is weather related delays, etc that may fall back on the travel agent for not advising the client it can rain and even snow in Boston in January. Need we say more? You really do need to protect your business from potential lawsuits when things don’t always go as planned.

Health Insurance

Health Insurance, Disability, and Life Insurance should be looked at not only for you, the owner, but also if you have employees. It can be an expensive proposition for a small home based agency, so you want to research carefully.

Workers Compensation Insurance

Workers Compensation Insurance is also going to be necessary if you have employees. It provides income and payments of medical costs if you or your employees are injured on the job. It is mandatory to provide this at a minimum level to all employees. Many states have consolidated workman’s comp insurance into easy to buy and affordable plans.

Business Interruption Insurance

Is there really an insurance for this? Do you think it would fall under the heading of “I need a vacation and want to be paid by the insurance for the time off ?” Sounds like a winner, but actually it is meant to protect against the loss of business income covering specified expenses should the business be temporarily shut down due to perhaps a need to remodel following a fire, an interruption in utilities or perhaps an employee strike. Unfortunately, agents who had this type of insurance quickly found out that it did not cover the loss of income from the COVID pandemic.

Well on that note, I will end my long and hopefully helpful insurance article for home based businesses and go pay my homeowners policy that is now due.